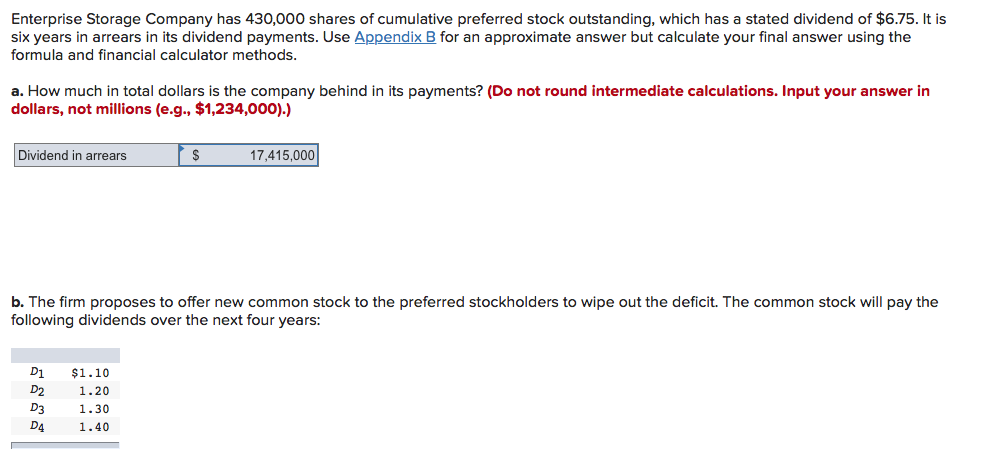

cumulative preferred stock formula

Each share has a par value of 100. Corporations issue preferred stock because the equity market may not be receptive to a new issue of its.

Preferred Stock Frequently Asked Questions

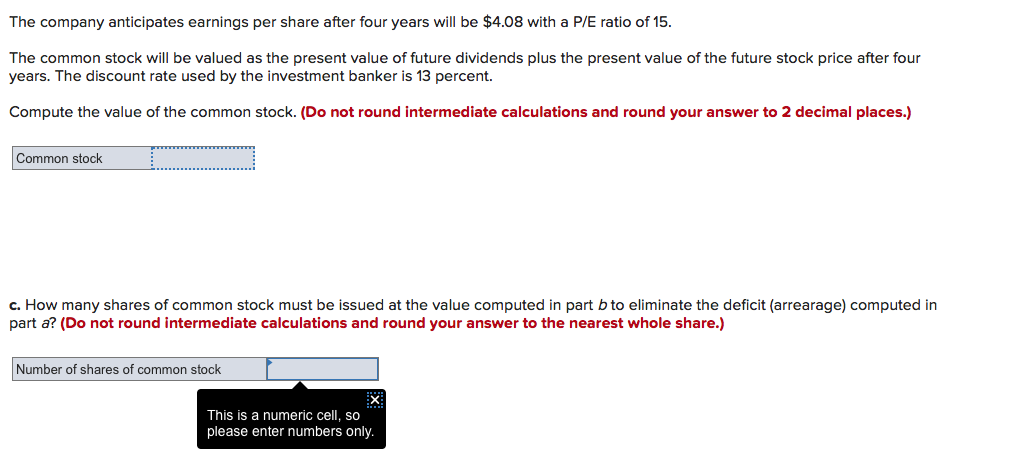

New preferred share issue.

. In other words par value is the. When the board of directors meets it determines the total dividend amount to be paid. A preferred stock investment might be the answer to your needs.

Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P. Preferred stocks typically have fixed dividend payments based on the stocks par value. Preference Equity Redemption Cumulative Stock - PERCS.

A convertible preferred stock with an enhanced dividend that is limited in term and participation. Number of preferred stock 2000. For example suppose you own 1000 shares of Company X cumulative preferred stock.

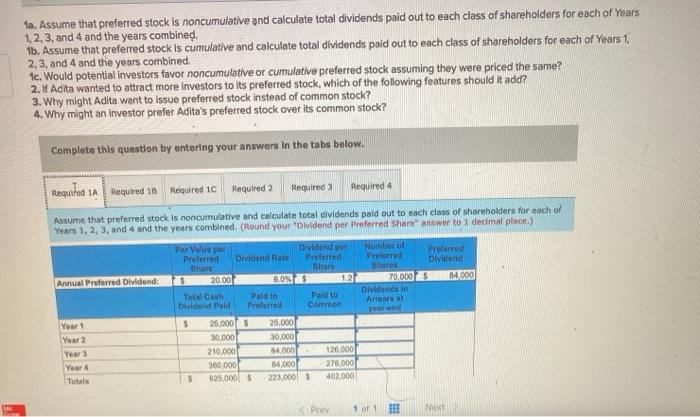

Dividends are paid out. The calculation for preferred dividends is different based on the features of the preferred stock if they are cumulative or non-cumulative and when the dividends are paid. Heres an easy formula for calculating the value of preferred stock.

Examples of a Cumulative Dividend 1. He would like to determine the. Preferred dividend Par value x Rate of dividend x Number of preferred stock.

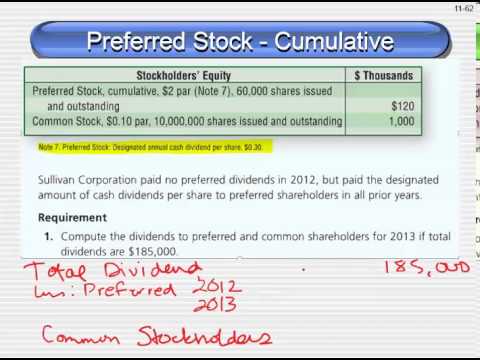

Colin is looking to invest in the new preferred share issue of ABC Company. A cumulative preferred stock is a type of preferred stock wherein the stockholders are entitled to receive cumulative dividends if any dividend payment is missed in. Because of the nature of preferred stock dividends it is also sometimes known as a perpetuity.

Where Preferred Dividend Rate The rate that is fixed by the company while issuing. The company calculates the amount to pay to preferred shareholders first. For this reason the cost of preferred stock formula mimics the perpetuity.

Par value 20. Rate of dividend 3 100 003. There are several simple formulas an investor in cumulative preferred stock should know.

If your preferred shares pay a 6 dividend rate and have a par value of 25 you can determine the cumulative dividends with the three steps discussed above. As referenced above cumulative preferred stock is a type of preferred stock. Cumulative preferred stock is a type of preferred stock with a provision that stipulatCumulative preferred stock is a type of preference share that has a provision thThis class of shareholders is to be paid ahead of other classes of preferred stock shCumulative preferred stock contrasts with non-cumulative preferred sto See more.

Quarterly dividend payment annual dividend 4. Cumulative Dividend Formula Preferred Dividend Rate Preferred Share Par Value. First calculate the preferred stocks annual dividend payment by.

How To Calculate Cumulative Dividends Per Share The Motley Fool

Non Cumulative Preference Shares Advantages And Disadvantages

Corporations Dividends Retained Earnings And Income Reporting Ppt Download

Solved Enterprise Storage Company Has 430 000 Shares Of Chegg Com

Preferred Shares Everything You Need To Know Aai

Solved 10 Assume That Preferred Stock Is Noncumulative And Chegg Com

Venture Capital Financings Understanding The Liquidation Preference Allen Latta S Thoughts On Private Equity Etc

1710 Financing With Common Stock Preferred Stock Overview 1710 Financing With Common Stock Preferred Stock Overview By Accounting Instruction Help How To Facebook Corporate Finance

Solved B C D E G Function Sum Formula Multiply Subtract Cell Course Hero

Preferred Stock Dividends Example Youtube

Quiz Worksheet Cumulative Preferred Stock Formula Study Com

Cost Of Preferred Stock Kp Formula And Calculation

Common Stock Formula Calculator Examples With Excel Template

Cumulative Dividend Meaning Feature Formula Commerce Achiever Commerce Achiever

Solved Dividends Per Share Seventy Two Inc A Developer Of Radiology Course Hero

Solved Please Fix Incorrect Answers Thank You On December 31 2020 Course Hero

Preferred Stock Accountingcoach

Earnings Per Share Flashcards Quizlet

Solved Enterprise Storage Company Has 430 000 Shares Of Chegg Com