georgia ad valorem tax 2021

Details on Georgia HR 756 Georgia 2021-2022 Regular Session - Ad valorem tax. Advertising and notice requirements pertaining to millage rate adoption.

The tax must be paid at the time of sale by Georgia residents or within six months of.

. Get the estimated TAVT tax based on the value of the vehicle using. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. The Annual Ad Valorem Tax is determined on an annual basis and is required to.

The actual filing of documents is the veterans responsibility. PTS-R006-OD2020 Georgia County Ad Valorem Tax Digest Millage RatesPage 13 of 43. MV-9W Please refer to this form for detailed instructions and requirements.

March 17 2021 513 PM. Title Ad Valorem Tax Estimator calculator Get the estimated. DEKALB STONE MOUNTAIN 21000.

Georgia Tax Center Help Individual Income Taxes Register New Business Business Taxes Refunds Information for Tax Professionals. 1 to the County Tag Agent. Yes if applicable Required Forms.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. DEKALB TAD - 1 KEN14 T114. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

To provide for effective dates. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. Ad Valorem Tax on Vehicles.

Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Under Cars and Other Things You Own- Show more and Start or Revisit Car Registration Fees.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. 10 to Sponsoring Organization. And a timely Order can be issued by Commissioner authorizing the billing and collection of ad valorem taxes.

Georgia House Bill. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction.

The TAVT rate will be lowered to 66 of the fair market value. Mar 26 2021 1033 AM. Title Ad Valorem Tax TAVT - FAQ.

Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. Qualified low-income building projects may be classified as a separate class of property. 20 Annual License Reg.

If itemized deductions are also. Cost to renew annually. Georgia law requires each county levying and recommending authority to provide certain disclosures to taxpayers prior to the establishment of the annual millage rate for ad valorem tax purposes.

Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax. DEKALB TAD - 1 KEN04 T104. 80 plus applicable ad valorem tax.

Local state and federal government websites often end in gov. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. To provide for a referendum.

County District MO Bond. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020.

Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows. Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. The two changes that apply to most vehicle transactions are.

This tax is based on the value of the vehicle. GEORGIA DEPARTMENT OF REVENUE. Georgia HB1607 2021-2022 A BILL to be entitled an Act to provide a homestead exemption from Taylor County school district ad valorem taxes for educational purposes in the amount of 10 percent of the assessed value of the homestead for residents of that school district who are between 70 and 74 years of age in the amount of 15 percent of the assessed value of the.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. To enter your Personal Property Taxes take the following steps. Subject 560-11-14 State and Local Title Ad Valorem Tax Fee.

Subject 560-11-14 State and Local Title Ad. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. A BILL to be entitled an Act to provide a homestead exemption from Bartow County school district ad valorem taxes for educational purposes in the amount of 6000000 of the appraised value of the homestead for residents of that school district who are 65 years of age or older in the amount of.

A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to provide for a state-wide exemption from all ad valorem taxes for timber equipment and timber products held by timber producers. The Annual Ad Valorem Tax is imposed on vehicles that have not been taxed under the Title Ad Valorem Tax in Georgia. 5500 plus applicable ad valorem tax.

1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle. Ad Valorem Tax Required. Details on Georgia HB 75 Georgia 2021-2022 Regular Session - Ad valorem tax.

Property Taxes Laurens County Ga

Tax Rates Gordon County Government

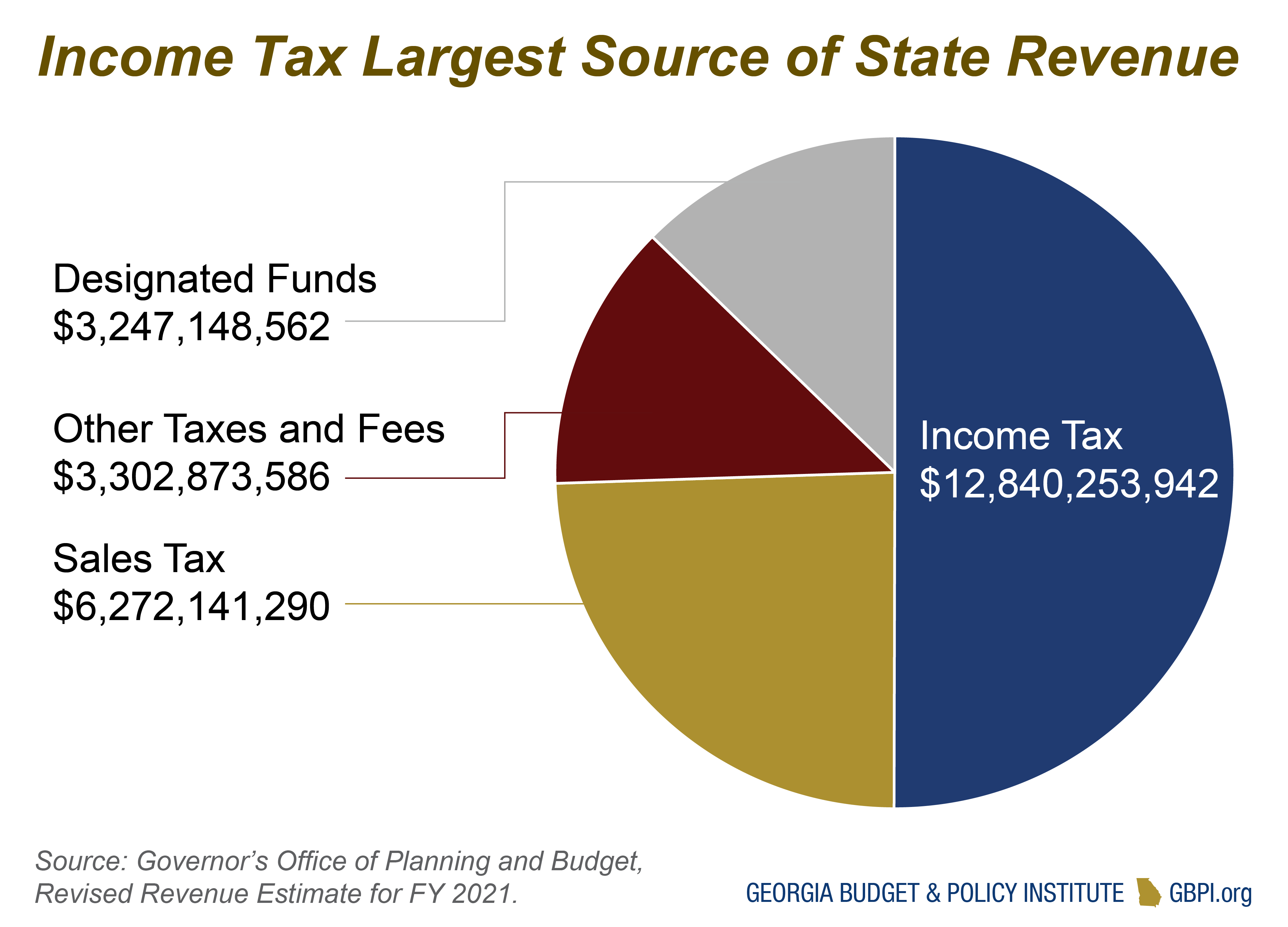

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

542 Henry Higgins Rd Jackson Ga 30233 3645 Lhrmls 00873684 Lakehomes Com In 2021 Waterfront Property Real Estate Houses Vinyl Exterior

2021 Property Tax Bills Sent Out Cobb County Georgia

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Tax Rates Gordon County Government

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Used Car Sales Tax Fees

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax Retirement Money Retirement Strategies

![]()

Georgia New Car Sales Tax Calculator

Georgia Sales Tax Small Business Guide Truic

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes