san mateo tax collector property tax

However you have until 500 pm. For comparison the median home value in San Mateo County is 78480000.

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

For specific information please call us at 866 220-0308 or visit our office.

. Property tax payments will be accepted per this schedule. Of December 10th to make your payment before a 10 penalty is added to your bill. San Francisco CA 94080.

The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. Total Direct Charges and Special Assessments. What are unsecured property taxes.

Tax payments must be received or postmarked by the due date to avoid penalties. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Mateo County Tax Appraisers office. You also may pay your taxes online by ECheck or Credit Card.

San Mateo County collects on average 056 of a propertys assessed fair market value as property tax. How are the unsecured tax amounts determined. Announcements footer toggle 2019 2022 Grant Street Group.

TAX COLLECTION QUESTIONS. The Office of the Treasurer Tax Collector is open from 8 am. Online Property Taxes Information At Your Fingertips.

If the unsecured tax is not paid a personal lien is filed against the owner not the property. Search Valuable Data On A Property. Effective April 11 2018 hours of operation in this SSF office only will change.

South San Francisco Satellite Office. Such As Deeds Liens Property Tax More. Ad Get In-Depth Property Tax Data In Minutes.

1024 Mission Road S. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. The San Joaquin County current year property tax roll is available online for inquiry or to make a payment by credit card debit card or E-Check.

For owners with an aggregate cost of less than 100000 the Assessor may request that a statement be filed. Sandie arnott tax collector san mateo county 555 county center 1st floor redwood city ca 94063 after add 10 penalty and 4000 cost toyour payment total delinquent installment due. Dan McAllister Treasurer-Tax Collector San Diego County Admin.

Visit the Tax Collectors website for m ore information on Unsecured Property Taxes. Countywide Tax Secured 100000000. What period of time does an unsecured tax bill cover.

Countywide Tax Secured 100000000. Taxing authority Rate Assessed Exemption Taxable Tax. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner.

Ad Find San Mateo County Property Tax Info For Any Address. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. 2019 2022 Grant Street Group.

With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. Walk-ins for assistance accepted until 4 pm. To request a claim form email the Assessor Division and include the property address your mailing address andor your Assessors Parcel Number.

Payments at the cashier window accepted until 5 pm. Monday through Friday in room 140. When is the unsecured tax assessed.

The 1st installment is due and payable on November 1. Property Tax Look-up County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. See Property Records Deeds Owner Info Much More.

Sandie arnott tax collector san mateo county 555 county center 1st floor redwood city ca 94063 make checks payable and mail to. San Mateo County secured property tax bill is payable in two installments. The 2nd installment is due and payable on February 1.

San Mateo County residents may request a Homeowner Exemption claim form from this website. Office of the Assessor. If a payment is received after the due date.

SMC MOSQ ABATEMNT ASSMNT. The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308. Start Your Homeowner Search Today.

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. Search Any Address 2. The following are questions we often receive from San Mateo County unsecured property owners.

The tax is assessed against such things as business equipment fixtures boats and airplanes. In fulfilling these services the Division assures that the County complies with necessary legal. San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143 counties in order of median property taxes.

Property Tax Bills and Refunds San Mateo County Assessor-County Clerk-Recorder Elections - ACRE. Get In-Depth Property Reports Info You May Not Find On Other Sites. The grace period on the 2nd installment expires.

Center 1600 Pacific Hwy Room 162 San. Residents of other counties should contact their local assessors office for these forms. Taxing authority Rate Assessed Exemption Taxable Tax.

Payment plans may not be started online.

Secured Property Taxes Tax Collector

![]()

County Of San Mateo 1615 Updates Mdash Nextdoor Nextdoor

San Mateo County Ca Property Tax Search And Records Propertyshark

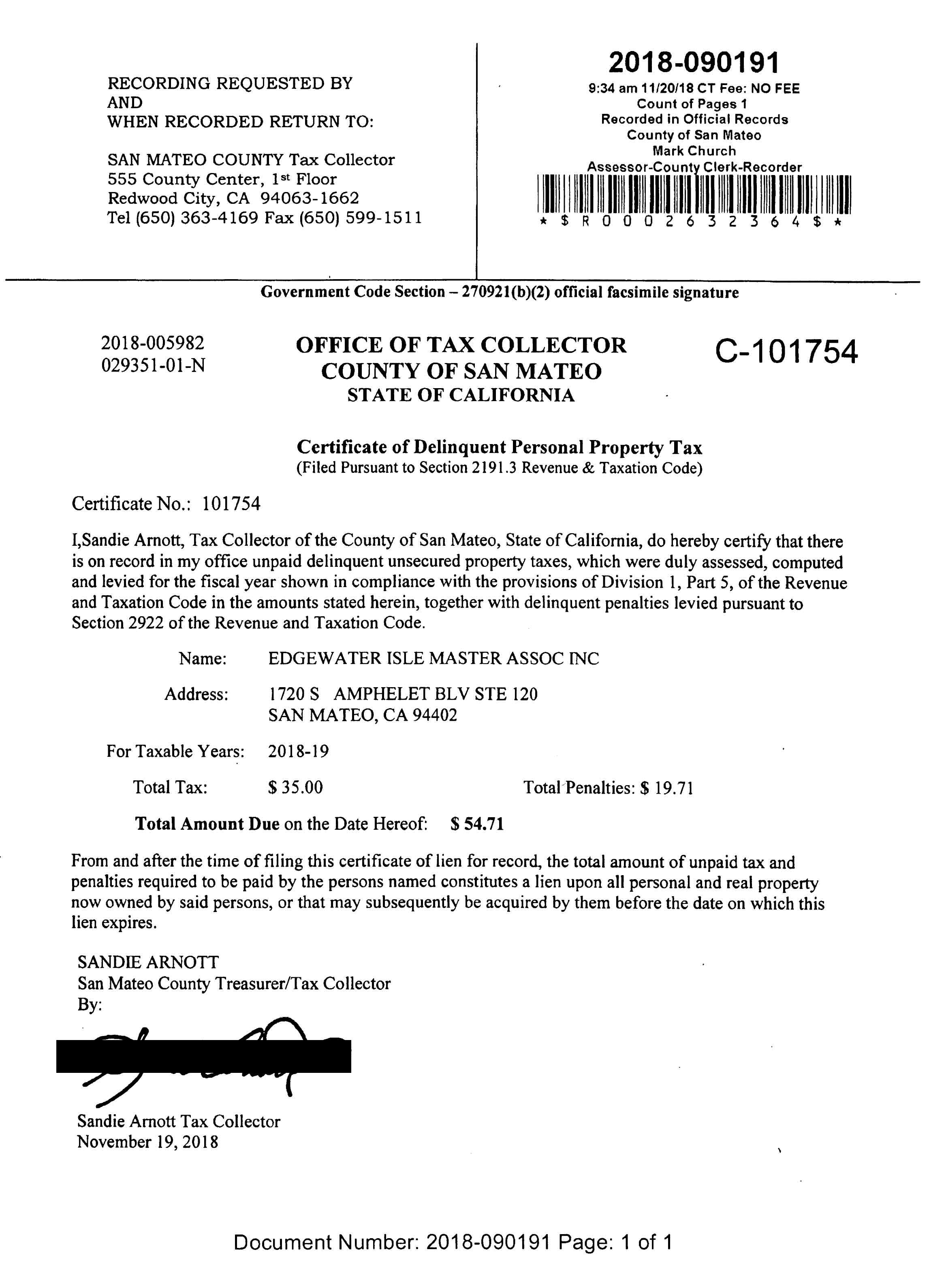

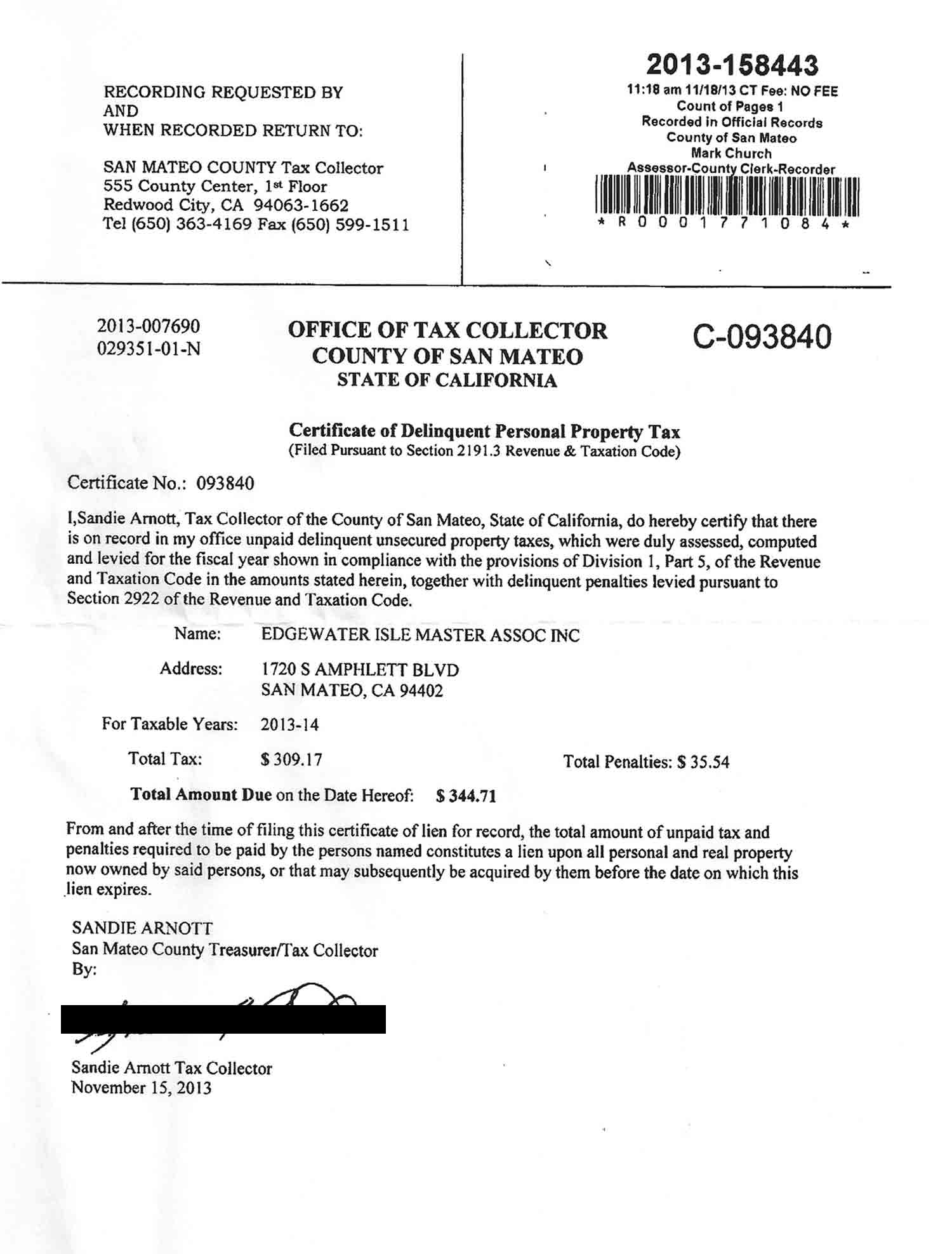

San Mateo County Issues Liens Against Master Association

San Mateo County Issues Liens Against Master Association

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

2018 Property Tax Highlights Publication Press Release Controller S Office

Secured Property Taxes Tax Collector

San Mateo County Extends Property Tax Deadline To May 4 Climate Online

San Mateo County Ca Property Tax Search And Records Propertyshark

Property Tax Search Taxsys San Mateo Treasurer Tax Collector